I often enjoy Joe Nocera’s take on Wall Street, but like some other well known financial writers, he has become overly close to his subjects. No where is this more evident than in a stunning little aside in an otherwise not bad piece on the Financial Crisis Inquiry Commision’s report, which points out that it is long on potentially helpful detail, short on analysis.

Here is the offending section:

But I wonder. Had there been a Dutch Tulip Inquiry Commission nearly four centuries ago, it would no doubt have found tulip salesmen who fraudulently persuaded people to borrow money they could never pay back to buy tulips. It would have criticized the regulators who looked the other way at the sleazy practices of tulip growers. It would have found speculators trying to corner the tulip market. But centuries later, we all understand that the roots of tulipmania were less the actions of particular Dutchmen than the fact that the entire society was suffering under the delusion that tulip prices could only go up. That’s what bubbles are: they’re examples of mass delusions.

Was it really any different this time? In truth, it wasn’t. To have so many people acting so foolishly required the same kind of delusion, only this time around, it was about housing prices. Getting to the bottom of that requires less the skills of an investigator than the talents of a psychologist.

This verges on counterfactual as far as both the tulip mania and our crisis just past are concerned.

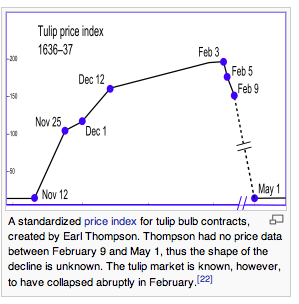

Recent research shows that much of the popular view of the tulip mania is myth. First, its acute phase was short in duration, lasting a mere five months, and appears to have been set off by the creation of a futures market, which allowed for levered bets to be made (it is admittedly difficult to get conclusive information, and a lot of the futures trades entered into were never actually completed).

Second, the mania did not sweep Dutch society Comparatively few people were involved, and contrary to Nocera’s account, borrowing played little to no role in the speculation. Per Wikipedia:

While Mackay’s account held that a wide array of society was involved in the tulip trade, Goldgar’s study of archived contracts found that even at its peak the trade in tulips was conducted almost exclusively by merchants and skilled craftsmen who were wealthy, but not members of the nobility. Any economic fallout from the bubble was very limited. Goldgar, who identified many prominent buyers and sellers in the market, found fewer than half a dozen who experienced financial troubles in the time period, and even of these cases it is not clear that tulips were to blame.[35] This is not altogether surprising. Although prices had risen, money had not exchanged hands between buyers and sellers. Thus profits were never realized for sellers; unless sellers had made other purchases on credit in expectation of the profits, the collapse in prices did not cause anyone to lose money.

In addition, some economists even contend that the price rise in tulips (which was less than the classic account by Charles Mckay indicates) was warranted by fundamentals (although the idea of a “fundamental value” of tulip bulbs, which were a luxury items, sounds difficult to establish). By contrast, housing debt is bigger than the US Treasury market, and homeowners were encouraged to spend their paper profits via home equity loans and second mortgages.

But whatever you make of the tulip mania, Nocera’s positioning is troubling. First, he repeats and amplifies an underlying fallacy of the FCIC report, that the crisis was at its root a housing bubble. That is simply not true. As we recounted on this blog in the months before its onset, there was an alarming compression of risk spreads in every credit market around the world. If this was a mania, how does Nocera explain it operating across all debt markets, most of which had nothing to do with US housing (take emerging market and the CLO market, for starters) and where prices were set by professional investors rather than the presumed gullible public?

In addition, the math simply does not add up for treating the housing market in isolation as the cause of the crisis. The subprime market is roughly $1.2 trillion. Even in 2009, expected defaults (ultimate, realized to date are considerably lower) were around 30%; they are now more like 40%. One can argue those aren’t all due to bad lending; we also have losses due to high and persistent un and underemployment (these are considered to be normal credit losses, as in “shit happens” as opposed to defective lending). So for the purposes of parsing out bad lending from knock on crisis effects, let’s use the 30% default level as representing bad lending decisions.

Even with a default, on housing, investors will get a recovery from the sale of the house. It’s much lower than in normal housing cycles, so we’ll use a 70% loss (as in 30% recovery). That gives you losses of about $250 billion, or 1.8% of GDP. This would have been a S&L level crisis (remember, we had dumped a lot of the bad paper on foreign banks) in and of itself, not a financial system heart attack.

One of my pet peeves is that the focus on housing qua housing completely misses other critical drivers that made bad housing debt the detonator of a global financial crisis. One was the activity of subprime shorts. For every $1 in BBB subprime bonds, Standard & Poors estimates ten times amount was created in CDS on those bonds, which were typically created as part of synthetic or heavily synthetic CDOs. And who was on the other side of those trades? Leveraged institutions that could not take much in the way of losses: AIG, European banks, US investment banks, monolines. And those dominoes falling set off other failures. For instance, commentators continue to ignore that the damage to the monolines led to the failure of the auction rate securities market (the dealers stopped propping it up because they did not want to hold inventory that would fall in value when the monolines were downgraded, which was clearly inevitable). The seize up in the ARS market in turn kicked off a series of disasters in the municipal market, as borrowers had to pay punitive rates on their ARS and often on related swaps.

Third, he seeks to shift blame from “particular Dutchmen” whose presumed counterparts today would be particular members of the financial services industry, and instead society as a whole. Since everyone is to blame, no one is to blame. That’s a very convenient posture for a reporter on the securities industry beat.

Nocera takes a similar, albeit less obvious, industry flattering view on the Dylan Ratigan show. Start watching at around the 5:20 mark to about 7:40:

Visit msnbc.com for breaking news, world news, and news about the economy

Nocera may sound reasonable, but his rejection of criminal cases is based on false dichotomies and straw men. He’s right that criminal cases in the financial arena are often hard to win, but that is no justification for throwing up your hands. And the Bear Stearns cases he cites unfortunately say more about how ill prepared the SEC is to pursue credit markets cases (not an area of SEC expertise) than whether that case was winnable.

The SEC’s prosecution of the case was widely seen as inept; it relied far too heavily on extracts from e-mails and the timing of certain trades made by the managers. In a huge lapse, they appear not to have grilled the defendants or done other discovery to ascertain whether the defendants might offer other explanations for these seemingly damning facts. This was a failure of basic litigation blocking and tackling, a rookie level mistake. So why doesn’t Nocera instead call for the SEC to beef up its litigation staffing, or bring in top courtroom talent, as he Department of Justice does upon occasion in high profile cases?

Nocera conveniently forgets that Eliot Spitzer threatened to indict AIG on accounting fraud (amusingly, the Wall Street Journal harrumphed about how abusive that was, when AIG’s using finite reinsurance and later proof of continued lax controls, as witness its $20 billion losses on its securities lending attest) and that Ken Lay, Andy Fastow, and Jeff Skilling were all convicted in Enron, the mother of financial complexity. In the end, sixteen Enron employees pleaded guilty, and five more individuals, including Merrill Lynch staffers, were convicted.

In the movie Inside Job, Spitzer set forth the way to get convictions at big financial firms: start with the widespread use of company funds to pay for drugs and prostitutes for employees and clients. Use that wedge to get staff to turn evidence of financial crimes. With insiders providing a road map and testimony, criminal prosecutions become winnable. All it takes is a prosecutor with guts and a squeaky clean personal life.

What real choice did people have when the government backed counterfeiting cartel (the banks) was blowing the housing bubble? Were they supposed to sit on the side lines, earn negative real interest rates on their savings and be priced out of the housing market forever?

No, the fault does not lie with the general population.

And since the general population is not guilty then justice requires that THEY be bailed out. And not coincidentally, I would bet, a general bailout would fix the entire economic system from the bottom up.

This is crazy. Millions chose not to purchase houses at the same time millions chose to. These decisions can’t be categorized as correct, incorrect, moral, ethical, unethical or any other label you can think of. They were simply decisions made by people about how they wanted to live their lives. What “bailout” is needed for people living with their own decisions?

The answer is that no one should get a bailout. Ever. Investments entail risks. When has it ever been different? It’s a simple matter of morality.

The “wealth” created during the bubble was phony, and therefore, the “wealth” now being destroyed would have not existed without the bubble.

The positive is, houses that otherwise would not have been built, did get built, and that is a good thing.

Those that didn’t buy into the bubble and felt that they had missed out now get to buy at a firesale price. They get to buy a home that will cost a lot less than what it cost to build, but they will pay a price that makes sense based on the number or homes in the country, and what is the ability of marginal buyers to pay for shelter. Take into account, higher unemployment, lower wages, higher costs for food and energy, and high property taxes, and house prices fall to levels most people cannot comprehend. What other options do the banks that have foreclosed on these properties have? The longer they hold on to them, the more they pay in property taxes and vacancy costs.

So, wait. Prices will be lower than you ever dreamed possible. Nobody has lost a home. Without a housing/credit bubble, these homes would never have been built, and all the jobs they created would have never existed. So, nobody is really losing anything. The good thing is that homes now exist that they will be able to occupy, regardless of their limited income. Because what other choice exists for these homes? Is anybody better off just to leave them vacant?

I agree with you. And the longer they’re vacant they become damaged(snow, wind etc. recently) and neighborhoods become a place for vandals.

Your point about the housing bubble not creating real wealth is well taken and everyone reading this post needs to take several minutes, do some emotional focusing and admit that we have been taken to the cleaners as a nation so our pocketbooks could be vacuumed for what ever remnants of real wealth we did have. The relationship between cash-money, investments, and real wealth (there is one) needs to be spelled out in exact detail by someone who has all of the numbers. I understand it would not be a pretty picture showing that most of us have trivial amounts of economic wealth. We are living on the edge of a tottering wall.

Wrong! The wealth destroyed from the collapse of the housing bubble as only partly phoney. Since high finance has not found a way around the “conservation of enery/matter laws” You must concede that the nonfinancial inputs *materials and labour* have been an actual loss. As have those portions of the financing which were done with ‘real money’. The real money part as probably not destroyed so much as redistributed?? Ditto for the phoney ‘generated wealth’, a certain part of which has been siphoned to the appropriate pockets.

Outstanding! Thanks for clarifying this for me. There is so much noise about macroeconomics that I often forget how little things have really changed for those of us who actually understand the concept of intrinsic value. It’s the millionaires who are “suffering” in that they no longer make 90 million dollars a year but instead have to scrape by on 2 or 3 million dollars a year instead. It’s a bitch when your mortgage is 10 million. lol.

Don’t be fooled. Even at current prices, houses still cost far more than they cost to build, which is a whole topic unto itself. Builders aren’t losing money on houses, they’re just not making as much profit as they did during the bubble. The problem (for builders) is that they raised salaries during the bubble and after the bubble popped, they’re not bringing in enough profit to cover them.

The entire point is missed. For one, there were hundreds of thousands of homes that were flat out too big and above the needs of the purchasers, who wanted to feel like landed gentry when in many cases they were hauling garbage for a living. Second, this is a credit bubble and the associated creation of cash through equity extraction and sale proceeds of inflated housing provided a massive cash flow through the economy and around the world. Third, houses don’t inflate, land does. You would be shocked how cheap homes get when the lot gets cheap. People could buy stock, consumer goods, finance cars, pay for college with mortgage credit. Also, the multiple of annual income involved in making a mortgage is a drag on future income, a financialization of the economy in general and a perpetual debt that weighs increasingly on the economy. A mortgage of one years income can be paid off, should the mortgagor get tired of paying the mortgage, but it is highly doubtful most people have a plan as to how to get rid of 3 or 4 years income in debt. 30 years is a hell of a long time, almost 3/4 of a typical working life and many buy houses in their 50’s and 60’s. The amount of debt is just as important as the default of debt in this case. Throw in the additional cost of living in a monstrosity the size many bought with higher utility costs, insurance costs and maintenance costs becomes an anvil to many.

So we built homes that are “too big”. If this allows families to double up and reduce their rent costs, it brings rents down even more as there are even more vacant “investment” properties on the rental market. For the majority of people living paycheck to paycheck (whether from work, UI, or welfare/foodstamps), this is a godsend!

In regards to labour inputs being wasted, had it not been for the housing bubble, these inputs would have been idle/wasted anyways, the same way they are now as we have massive unemployment and underemployment. The mess that we find ourselves in today would have just occured eight years earlier, and we wouldn’t have the housing inventory in place.

This was a sell-side (credit giving) bubble, not a buy-side (credit-taking) bubble. The blatantly false narrative, pushed by the perps and their fawning PR flacks, is that “‘They’ made us do it.” What bullshit. This bubble was forged by the excreta trifecta of pyramided bets, laughabley miniscule reserves against losses on those bets, and fraudulent representation of the those bets by the pyramiders to their marks. This was all done _inside the financial industry_. The critical enabler of this bubble wasn’t a great, financially illiterate, unwashed ‘Them’ but the degregulation of the perps by their cronies in government, so that they were able to roll those pyramided bets out the front door where previously that would have landed them in jail. Which is where they, the financial industry perps belong. To the extent to which there was a buy-side driver of all this—subprime mortgages dangling the promise of financial security to millions who never had had such a chance—it was created BY THE FINANCIAL INDUSTRY so as to have product to move up the chain in those securitized, pyramided bets to be onsold to the marks.

Was there a quality of mania-c fabulation afoot in the populace on the putative valuation spike of their mortgated or owned real property? Yes, but as Yves sketches with typical and commendable efficiency a not exceptional, not Depression-inducing bubble. And that fabulation wasn’t a _cause_ of the bubble but an effect. As in, once the financial industry perps induced a spike in paper valuations via their rigged enabler chain of evaulators-boilershop loaners-bundlers-secureres-sellers, the public holding mortagages were induced to refi and take cash out in _another_ industry-created straw-into-gold operation.

Everything in this financial crash leads back to the top of the financial industry. The food chain rotted from its head, not its tail. And that’s a tale the perps are busy hiring every shill with a byline to push as we head back down the double dip of the depression that never ‘recovered’ further than recession or the public at large, at best.

It’s true there was a cottage industry in flipping properties, spurred on by the financial guru industry. Lots of infomercials sucking up cheap time on cable TV. Free seminars in a hotel ballroom where every participant got a free thumb drive just for attending. Expensive seminars and boot camps to explain attitudes. Articles in Readers Digest and stories from someone your cousin heard about. Hours of video. Books and books and books and books and books. Think Rich Dad, Poor Dad, probably the biggest single promoter.

But again, this was a cottage industry. While the flippers and their thing about OPM added to the pressure on prices, and still does in some areas, it wasn’t in the tens of billions thrown around in the derivative markets. It wasn’t an instrument based on an instrument based on an instrument. And it was, ultimately, big money poured into real estate by the mortgage companies with no questions beyond how to pour in more. Scale matters.

In any case, it was the financial derivatives that lost buyers and fell, not the housing. It was the big money banks and hedge funds who bribed the rating agencies. It was the big money that bought enough government to operate their dealing. There was a mania was confined to a small group of traders intent on the deal. There was a mania, but it was a cold-blooded one.

http://www.erictyson.com/categories/20090120_1

http://johntreed.com/Reedgururating.html

“Nocera may sound reasonable…”, so did Judy Miller.

Richard Kline is correct the cause was sell-side (credit giving) bubbles but we need to remember that a bet on a bet is also the provision of credit as well as the money lending loan. It is the permitted existence of all these inflating activities with no sensible risk rules of thumb that create the boom-bust cycles within predator capitalist societies. We should fear that excessively authoritarian China has successfully taken up Chartalism together with tight regulation of speculative activities to control the boom-bust cycles. Nazi Germany did the same and in the short space of eight years rebuilt its economy so successfully that it took five years of war to defeat its military strength. China is marching down the same road. Predatory capitalism is not only destroying our livelihoods it is in the parallel process of ultimately destroying our right to protest against the imposition of authoritarian regimes.

Schofield said:

We should fear that excessively authoritarian China has successfully taken up Chartalism together with tight regulation of speculative activities to control the boom-bust cycles. Nazi Germany did the same and in the short space of eight years rebuilt its economy so successfully that it took five years of war to defeat its military strength.

I don’t believe the situation that existed in Nazi Germany is as you describe it. Correct me if I’m wrong, but what you are saying is that 1) there was a strong state in Nazi Germany that stood as a counterweight to the corporations and 2) this strong state kept the most abusive practices of the corporations in check.

The other day Paul Tioxin provided a link to this essay

that paints an entirely different picture than you do of the relationship between corporations and state power in Nazi Germany:

To define “capitalism” as consisting of the “free competition” of a large number of independent entrepreneurs with freedom of contract and trade is, of course, to speak of the past. A more enduring trait, and therefore one better fitted to be seized upon in a definition, is the major institution of modern society: private property in the means of production. Now rapid technological change, requiring heavy investments, further augments the gobbling up of the little by the big and this monopolization eventuates in an extremely rigid economic structure. Powerful corporations demand guarantees and subsidies from the state. Thus, in the era of monopolization “the administrative act” and not “the contract” becomes “the auxiliary guarantee of property.” Intervention becomes central, and: “who is to interfere and on whose behalf becomes the most important question for modern society.” In Germany, as seen by Neumann, National Socialism has tied the economic organization into the web of “industrial combinations run by the industrial magnates.” By means of the newer implementation of property, the administrative command, the cartellization of German business has proceeded rapidly. The Nazis saved the cartel system, whose rigidities were sorely beset by the depression. Since then their policies have consistently resulted in a further monopolization into the orbit of the big corporations. The cartels and the political authority have been welded together in such a way that private hands perform such crucial politico-economic tasks as the allocation of raw materials.

But who runs the giant cartels? Behind cartellization there has occurred a centralizing trend which has left power decisions and profits in the lap of the industrial magnates, realized many an old dream not shared by the now regimented workers or the small business men now virtually eliminated. The dreams come true in Germany may well be those of the industrial condottiere everywhere. Among specific Nazi politics which have implemented this oligarchification of capitalism is Aryanization: Jewish property expropriated has not gone to the “State,” but to industrialists such as Otto Wolff and Mannesmann. (Apart from the Jewish case, there is a definite trend away from any thought of genuine nationalization.) The power of such industrial combines has also been augmented by the “Germanization” of business in conquered territories. The “Continental Oil Corporation” of Berlin is predominantly composed of the most important German banks and oil corporations. Heavy industry in Lorraine was equitably distributed—-among five German combines. More important than these processes has been the industrial revolution in chemistry, subsidized by the State, but deriving its dynamic from capitalism, and rendering power to giant combines in the same way that all property in the means of production confers power, but more brutally. The hard outlines of the cartel powers are further confimed by the near assimilation of finance capital by the monopolists of industrial capital.

Neumann has shown that profit motives hold the economic machinery of the Reich together. But given its present monopoly form, capitalism demands the stabilizing support of a total political power. Having full access to and grip upon such power is the distinctive advantage of German capitalism.

Yes..That is a pretty good road map for the modern Globalization proponents. In the middle of the quote I was reminded of the current state of affairs in Banking: where the government shuts down small banks and hands them to the TBTF with their “Much better financial controls”..lol

I suggest asking Nocera if he has a clause in his contract either with his publisher, or the Times that stipulates that he avoid the “F word.” It might be worth asking. Or maybe he’s too much of a Poodle, and keeps his own claws filed short.

I read the transcript of an interview, and his FDL Book Salon blog, and try as they might, none of his questioners could get him to respond to the question of fraud. He did not respond to any of the blog questions that suggested fraud, and side-stepped away in the interview.

It’s not plausible at this end-stage of US Capitalism, that any employee of a major media outlet would dare tell more than the limited hangout version of this, or any other scandal.

http://www.econtalk.org/archives/2010/12/nocera_on_the_c.html?source=patrick.net#f1

http://fdlbooksalon.com/2011/01/08/fdl-book-salon-bethany-mclean-and-joe-nocera-all-the-devils/

Mike Ruppert, in Crossing the Rubicon wrote this:

The why and the how

It is my belief that sometime during the period between late 1998 and early 2000, as certain elites became aware of the pending calamity of Peak Oil, they looked at the first highly confidential exploration and drilling results from the Caspian Basin and shuddered. The economy had already been milked close to collapse, and the Caspian results could not be kept secret forever. The data woud surely come out, and what woud happen to the markets then” What if some of the major oil companies had been inflating Caspian numbers and hyping-up hopes of a bonanza in order to pump their stock value? What if all the inflated reserve estimates revealed themselves to be bogus all at once?

A major economic collapse was imminent in the fall of 2001….

It is likely that some of those early Caspian drilling reports came from companies like Exxon-Mobil, where Condoleezza Rice sat on the board. She was an expert on Kazakhstan. The elites began to grasp that the hoped-for Caspian reserves would not even offer a short reprieve from the onslaught of Peak Oil. Through declassified CIA reports we know that the CIA was aware that US oil production had peaked in 1970 and that the Agency was tracking Soviet oil production in the hopes of predicting a Russian peak in 1977. The CIA is Wall Street. Even if the oil had been there, it could not be monetized, because there was no safe route or pipeline to get it out. Alarms started going off.

It was time for the major players to cash out, and that’s what some 20 giant corporations from Enron to WorldCom, to Merck, to Halliburton did, as those in the know pumped and dumped their stocks, sucking the wealth out of pension funds, small investors, and mutual funds from 2000 to 2002. For the most part only the smaller investors and funds were hurt. The people on top cashed out and moved “their” money elsewhere.

p. 572-3 [Copied from scribd. Any errors/typos are mine.]

http://www.scribd.com/doc/8032220/Crossing-the-Rubicon-by-Michael-Ruppert

The planning for MERS, which can be considered to be a core cabal of the plotters of the housing con began in the early-mid 1990’s.

I think it’s safe to say that the plan to dispense with the US middle class and move the engine of Capitalism to Asia was hatched in the 1970’s. Since then it’s just been a matter of engineering pump-and-dumps to grab all assets.

AR,

Nocera is like any “establishment journalist”; he is not there to uncover the facts and let the chips fall where they may. That would be the job of investigative journalists, like Jeremy Scahill for example.

By contrast, just examine what Glenn Greenwald write about “establishment journalists” and see if it fits Nocera’s behavior.

http://www.salon.com/news/opinion/glenn_greenwald/2010/12/28/cnnn

The piece I’m referring to is about Wikileaks, government officials and the behavior of journalists; just replace Wikileaks by Wall Street, adjust for financial instead of political context and the comparison becomes eerie.

Some examples:

Now, replace “anti-WikiLeaks, “Assange = Saddam”” by “pro-financiers, “Wall Street = crisis yes! Crime no!”” meme and Voila!

Thus, as Glennzilla point out so aptly, it can’t be surprising that you cannot see

Personally, I have yet to read from any US financial journalist that is a Name, an article that goes radically against the vapid pablum of Nodrama Obama and TurboTax Timmy.

All anyone really needs to know about Wall Street criminality was disclosed by Frank Partnoy’s book, FIASCO, which was published either in 1997 or 2000.

One of the underlying causes no one seems to notice was the gullibility and ineptitude of buy side “money managers” desperately reaching for yield to justify their continued employment. Of course, they were reaching with other people’s money, which made that choice easier.

All this yelping for banker scalps remains futile. So many people committed so many crimes, you couldn’t prosecute two percent of them with the best will in the world.

What we really need is a way to remove leverage from the financial system without blowing it up. All those OTC derivatives are still out there ticking away, still generating fictitious profits to justify ill gotten bonuses.

jake chase said: “All this yelping for banker scalps remains futile. So many people committed so many crimes, you couldn’t prosecute two percent of them with the best will in the world.”

You’re just repeating Nocera’s and Eichmann’s exculpatory arguments.

This sophism, as Yves put it, has as its “logic” this: “Since everyone is to blame, no one is to blame.”

What is to blame is a refusal to understand the toxic effect of leveraged derivative contracts, the determination to preserve a toxic credit system in order to promote endless growth, the faith in an immoral Federal Reserve System, the hope that just “electing the right people”. or “government job creation” will make everything just fine.

The worst is definitely yet to come, since none of the real problems have begun to be addressed. The very idea that otherwise intelligent people can long for a creep like Eliot Spitzer or Rudi Guilliani to save the country is absolutely chilling.

I see, so you’d rather have creeps like Angelo Mozilo and Dick Fuld wreck the economy and get to keep their winnings? Some people who are effective are creeps (the sanctified Steve Jobs, not so sanctified any more Bill Gates and Steve Balmer, and Larry Elllison, for starters). Niceness typically has little to do with effectiveness.

I will voluntarily pay for Mr Spitzer’s first therapy session with the “come hither” therapist of his choice if he will indict at least one of the JPMorgan bankers involved in defrauding the people of Huntsville, Alabama.

You, Yves, above all people, understand that the crisis was preordained by changes in the law which enabled extreme leverage. I would prefer to see all investment bankers roasted over an open fire, but I cannot imagine any government of laws accomplishing much solely as a result of selective prosecutions, which are the only kind we ever get.

Jack,

You are promoting the meme that there was no fraud. White collar people are not afraid of giving up some of their ill gotten gains, but they are afraid of jail. Lehman was massive accounting fraud. So was Citi, there was clear mis-reporting. And that’s independent of deal-level misrepresentations (harder to prove given how watered down the regs were, admittedly).

LOL..Nobody is really willing to push that Big Red Button with “RESET” written on it. Until that happens nothing will change! Everyone is still desperatly hoping to preserve the few pie crumbs that fell on their plate..:(

Actually, we only have two choices: Voluntary Reset, which means shutting down the Banksters and purging the parasite now, or Involuntary Reset, which means allowing this charade to continue for another 50-100 years after which society and civilization will be so degraded that recovery may be impossible.

I prefer the former. Though I’m 60 and will therefore suffer the most from this option, I feel that it is preferable. My aspirations for the future of Mankind demand this course. There is no discernable benefit to the species from continuing on this path. People need to wake up and realize that individually we are irrelevant (specially to those running the show), as a collective consious we can determine the present and help shape the future. Why should a few megalomaniacs be allowed to control our destiny and the destiny of untold generations to come?

It’s highly doubtful that the system will last more than a decade. Debts can’t be repaid in a declining-energy economy. Which is undoubtedly one of the reasons for this theft, now, by those who know their days as banksters are numbered anyway.

TPTB, including law enforcement are all jockeying to lick the boots of those they see as their meal ticket through the coming chaos. The financial system will be the first to tumble as the oil shocks hit.

Gail Tverberg writes that this could happen as soon as this year. Yikes!

You must remember the money to drive the market in the 1990’s was created from somewhere. This was a worldwide bubble, despite the fact that Japan and the Tigers were deflating. Doug Noland of the Prudent Bear fund wrote a blow by blow account of the bubble starting in 2001. His October 19, 2001 post titled Franklin Raines, Director of Central Planning presents a picture of how the GSE’s in the 1990’s and forward were engaged in monetizing home equity. He posts excerpts from a speech Raines made that month to the Mortgage Bankers Association calling for doubling the amount of mortgage debt in the decade of the 2000’s. Mr. Raines’ prediction had come true by 2007, meaning he achieved his aim. You might note the amount of money the government is spending defending the past officers of the GSE’s.

This is one paragraph late in the post. The bottom half of this 2001 article is well worth a read for anyone wondering what happened, not only in the 2000’s, but in the 1990’s as well. Doug spoke in front of Congress back then and to say “No one saw this coming” is just pure bullshit.

The nation’s money supply and financial system are a public good, to be carefully guarded for the benefit of society as a whole. And, as the guardians of the currency serving as the key reserve for the global monetary system, we have responsibilities to our fellow citizens around the world. The U.S. monetary system is not Fannie Mae’s; it is not Wall Street’s. Regrettably, we have for too many years watched the Greenspan Federal Reserve shun its key responsibility for protecting the soundness and stability of the U.S. financial system. We have witnessed historic and absolutely reckless money and credit growth emanating from the Washington-based government-sponsored enterprises. During the past four quarters, Fannie Mae and Freddie Mac have combined to increase total assets by $268 billion, or 25%, to $1.4 trillion. This is an unprecedented credit expansion, surpassing by almost 30% the 12-month lending boom during the post-1998 crisis “reliquefication.” Over the past 12 quarters, Fannie and Freddie’s combined assets have ballooned a stunning $621 billion, or 86%%, to $1.34 trillion. (The Federal Home Loan Banks have yet to report third-quarter data, but the third of the “Big Three GSEs” has increased assets by almost $300 billion over this period). It is no coincidence that money market fund assets have increased about $940 billion during this three-year period. We have as well watched this Credit Bubble fuel an historic technology boom and bust, a nationwide housing inflation and over-consumption boom Bubble, and endemic maladjustments in what should be recognized as an unfolding fiasco. Too much true economic wealth has been destroyed, too many unsuspecting have lost their financial security, and too many specious financial claims have been created that will cause significant grief down the road. The economic prospects for future generations are being put in jeopardy by this nonsense. This has gone way too far, for too long.

The nation’s money supply and financial system are a public good, to be carefully guarded for the benefit of society as a whole. And, as the guardians of the currency serving as the key reserve for the global monetary system, we have responsibilities to our fellow citizens around the world. The U.S. monetary system is not Fannie Mae’s; it is not Wall Street’s. Regrettably, we have for too many years watched the Greenspan Federal Reserve shun its key responsibility for protecting the soundness and stability of the U.S. financial system. We have witnessed historic and absolutely reckless money and credit growth emanating from the Washington-based government-sponsored enterprises. During the past four quarters, Fannie Mae and Freddie Mac have combined to increase total assets by $268 billion, or 25%, to $1.4 trillion. This is an unprecedented credit expansion, surpassing by almost 30% the 12-month lending boom during the post-1998 crisis “reliquefication.” Over the past 12 quarters, Fannie and Freddie’s combined assets have ballooned a stunning $621 billion, or 86%%, to $1.34 trillion. (The Federal Home Loan Banks have yet to report third-quarter data, but the third of the “Big Three GSEs” has increased assets by almost $300 billion over this period). It is no coincidence that money market fund assets have increased about $940 billion during this three-year period. We have as well watched this Credit Bubble fuel an historic technology boom and bust, a nationwide housing inflation and over-consumption boom Bubble, and endemic maladjustments in what should be recognized as an unfolding fiasco. Too much true economic wealth has been destroyed, too many unsuspecting have lost their financial security, and too many specious financial claims have been created that will cause significant grief down the road. The economic prospects for future generations are being put in jeopardy by this nonsense. This has gone way too far, for too long.

http://www.safehaven.com/article/209/franklin-d-raines-director-of-central-planning

I might add that along with Paul Volker, Raines, Summers and Rubin were Obama’s primary economic advisors. Knowing this, is there any shock we are getting a smoky official version? The Warren Commission was merely a warm up to 1984. Now we prepare for 2012?

“All it takes is a prosecutor with guts and a squeaky clean personal life.”

What’s Patrick Fitzgerald doing these days?

CathyG says: “What’s Patrick Fitzgerald doing these days?”

What’s wrong with Eliot Spitzer?

We know his weaknesses and they are canceled out by Wall Street’s hatred for him.

What the hell, we’re not going to marry him. :^)

Bhaa! Wall street doesn’t “hate Elliot Spitzer”. The Sarbannes Oxley enforcement did more to concentrate power in the hands of Mega Corporations than any other legislation ever invented.

In one view, a crowd gets it into its head to stampede from a crowded theater. In another, one jackass shouted “Fire!” Judges have famously blamed the theater panic scenario on the shouting jackass, identifying the incitement as an act. Why does Nocera say the fire shouter is no different from the stampeders?

Ya the “Fire in a theater” scenario . The ultimate red herring IMHO. The opinion on this came out in a case in which the defendant was convicted for speaking out about the draft and telling people not to sign up. The ruling was that it’s not first amendment speech if that speech creates a “clear and present danger”. The clear and present danger was war and that verbally inhibiting the US from recruiting people to fight for the US put it at risk.

Does anyone really think that is analogous to yelling fire and a theater….? which has never happened BTW.

1. In numerous cases con artists blame their victims and the government. As one con artist said: “How could they have been so stupid as to believe me?”

2. Securities markets were desinged to bring savings to the producers and offer liquidty. The current system does not serve this purpose.

3. So long as the intermediaries that are supposed to serve these function are betting on market moves (which they help create) only the market will solve the problem. It is solving it. It has not yet completed its job. Look for the next coming bubble.

4.

Tamar

Yves said: “Third, he seeks to shift blame from ‘particular Dutchmen’ whose presumed counterparts today would be particular members of the financial services industry, and instead society as a whole. Since everyone is to blame, no one is to blame.”

It’s most intriguing that Nocera should chose that rhetorical strategy to exculpate the financiers, because it’s exactly the same defense Eichmann argued in his trial. But as Hannah Arendt responded in Eichmann in Jerusalem: A Report on the Banality of Evil:

[G]uilt and innocence before the law are of an objective nature, and even if eight million Germans had done as you did, this would not have been an excuse for you.

Of course, as the trial brought out, not all Germans did do as Eichmann had done. There were many who didn’t, as Arendt goes on to explain:

From the accumulated evidence one can only conclude that conscience as such had apparently got lost in Germany, and this to a point where people hardly remembered it and had ceased to realize that the surprising “new set of German values” was not shared by the outside world. This, to be sure, is not the entire truth. For there were individuals in Germany who from the very beginning of the regime and without ever wavering were opposed to Hitler; no one knows how many there were of them—-perhaps a hundred thousand, perhaps many more, perhaps many fewer—-for their voices were never heard. They could be found everywhere, in all strata of society, among the simple people as well as among the educated, in all parties, perhaps even in the ranks of the N.S.D.A.P. Very few of them were known publicly, as were the aforementioned Reck-Malleczewen or the philosopher Karl Jaspers. Some of them were truly and deeply pious, like an artisan of whom I know, who preferred having his independent existence destroyed and becoming a simple worker in a factory to taking upon himself the “little formality” of entering the Nazi Party. A few still took an oath seriously and preferred, for example, to renounce an academic career rather than swear by Hitler’s name. A more numerous group were the workers, especially in Berlin, and Socialist intellectuals who tried to aid the Jews they knew. There were finally, the two peasant boys whose story is related in Gunther Weisborn’s “Der lautlose Aufstand” (1953), who were drafted into the S.S. at the end of the war and refused to sign; they were sentenced to death, and on the day of their execution they wrote in their last letter to their families: “We two would rather die than burden our conscience with such terrible things. We know what the S.S. must carry out.” The position of these people, who, practically speaking, did nothing, was altogether different from that of the conspirators. Their ability to tell right from wrong had remained intact, and they never suffered a “crisis of conscience.”

The failure to punish free riding and anti-social behavior destroys the very glue that holds a society together.

For more on this there’s this essay from Hillard Kaplan and Michael Gurven. The researchers conclude:

We propose that multi-individual negotiations result in the emergence of social norms that are collectively enforced. We base this proposal on a result obtained by Boyd and Richerson (1992), and treated more recently by Bowles and Gintis (2000), in which cooperation can be stable in large groups, if noncooperators are punished and if those who do not punish noncooperators are also punished.

Down South:

If what you quote here is true:

then the US is on a path of social disintegration. The noncooperators have not only escaped any punishment, they’ve come out of a crisis they provoked more powerful and wealthy than before, precisely because those who could’ve punished them refused (for purely self-interested motives like electoral money) to do so.

By the way, I’m not strictly alluding to the financial crisis here. Dick Cheney and his criminal syndicate of war profiteers have ALL escaped punishment for war crimes, systematic torture and law breaking on a scale totally unimaginable in this country just, say, 15-20 years ago. Yet again, we find the same group of enabling cowards (Obama and his inner circle) in position of punishing the noncooperators but refusing to do so.

I’m afraid History will be very harsh when judging the legacy of Barrack Obama as president. Unless, of course, he decided to finally show some kahunas during his 2nd mandate, when he would be unencumbered by the burden of winning an election.

Allow me to harbor a galactic-size dose of skepticism here.

Bill Maher: The Democrats? Could they just grow one ball? I’m not asking for two. Just one. One ball.

Usually I reject reliance on “The Punishment Phase”, it is too much a part of Big Government. In this case I might need to compromise a bit. If only for the theatrical value of demonstrating to the masses that conspiring to destroy civilization is not acceptable.

Governments like the people who endorse them are mostly intellectually lazy. It is much easier to prohibit and punish than to enable and empower.

The bubble in which the New York financial reporters swim is very distorting and leads to skewed, useless “reporting” from nearly all of them.

For proof just look at what has happened to Gillian Tett since she relocated to NY. She has become as big a toady and suck up as Sorkin (worse, really, as she has no native antibodies).

Pretty funny! Yves, you make the Jeff Rubin argument, that mortgages written in Cleveland (Jeff’s words) couldn’t matter so much to rest of the world to drive the economy off the cliff. Jeff’s thesis was- and is an oil- price driven credit contraction. Since Jeff (and James Hamilton) makes a career out of this line of thinking there IS something to it.

Add to this (Sir) William Black’s ongoing systemic accounting control frauds you have the recipe for a crash.

Since nothing has been fixed the crash is also ongoing but in a non- dramatic sort of way that does not ‘scare the horses’.

Scares Egyptians, but who cares about them, they’re losers!

Modifying Rubin-Black with the Steve From Virginia thesis which is that what our economy calls ‘production’ is really anti- productive for a host of reasons related to resource overreach. Credit is substituted for wages: and fuel- guzzling machines for humans. The result is stupid humans and the ‘singularity’ occupying the same space.

We compete with our machines for resources. The ‘smart’ machines leave us at a disadvantage.

The exercise of credit accelerates resource depletion pushing up input costs which become generally bankrupting. Exercising credit also devalues labor which has become a (shrinking) class of entitled. Jobs vanish overseas while the country fills with people paid to drive in circles and watch TV.

The shrinking ice floe of employment becomes middlemen, hucksters and retail clerks who must all compete with the rentiers.

It’s not just credit management that is bankrupt, the economy from top to bottom is. It can only provide sufficient return to both labor and capital @ $35 oil. Higher crude prices require the economy rob from Peter (Ireland or Tunisian students) to pay Paul (Deutsche bank or US retired firefighters) who is in turn robbed to pay someone else.

Who to blame? Well, everyone. Since the problem is parked at the end of your driveway the consumers of the world are at fault. Operating a car is simply part of the flaccid and counterproductive whole which includes eating Greasy Macs, occupying the tract house and using the strip shopping center and box office ‘towers’ … none of which pay for themselves.

Yes, the fraudulents enabled the problem but someones had to buy in and buy big. Fraud was a legit hedge against rising fuel costs. So was/is the euro. Did any of this work? No.

The fraud that contains the little fraud orbits around labeling consumption as ‘productive’. We have a ‘work’ crisis not a credit crisis. The developed world has convinced itself that falling out of bed and getting dressed has economic value and that no further demands need be entertained. Society pays itself not to work — Chinese and Mexican slaves do this — does the paying with borrowed money all the while lying to itself that this is ‘productive’. Gimme a break!

If anything Nocera doesn’t go far enough.

I suggest you read my book. It provides an integrated explanation for the crisis, and certain policies and behaviors were instrumental. The “everyone is to blame” meme is patently false.

Careful Lady: I don’t think that was Steve’s point.

“Singularity” is the facilitator. The rest of ‘us’ in varying degrees have just been complicit. We have all participated in some way, just by participating or ignoring the scam. I’m not singling out anyone. I am as guilty as any.

Just consider your own profession. Do financial advisors create real wealth? Or do they just allow clients to make the best choices available to profit from the shell game?

I am not saying that ordinary people are guilty of anything other than being naive and lacking the moral fiber to stand up and protest what has been spoon fed to our theatrical percption of reality by the ‘captured’ MSM.

This is not new. Objectors have always been cast as Party Poopers and cranks, usually ignored and forgotten in the hung-over state where society searches for the next new high. Think how many are now hoping to get in on ‘alternaive energy’, hoping that if they are early enough, they can recoupe losses and lifestyle…

I’m not a “financial advisor”; that’s the retail sort. I do a combination of management consulting and transaction advice for large players, such as Forbes 400 types, hedge funds and PE funds, often valuation issues in market where the data sucks or the industry in question is undergoing fundamental change, so past is no predictor of the future. And I have created substantial value (billions, I am not exaggerating here, I can give you details off line if you really care to know) for my clients. So my hands are clean on that question.

No one can question your dedication to investigating and exposing the mortgage mess. The work you have put into this blog alone (with great dignity and exceptional patience), qualifies for some sort of economic Sainthood. Never mind the ground breaking work of your writing and speaking. I can only imagine your productivity in researching investments. I have no right or need to know the details of that. I would be even more envious..:)

Furthermore, I completely agree that there is much more to the “crisis”, than subprime mortgages. At least one more layer, perhaps two. If you remember the suggestion I sent you through Alex long ago, about the possible national benifits of an economic self-abnegation.

Also, I agree with your four pointer just above on all counts. Specially, that there is no reason to “move on” from an ‘unsolved’ problem, merely because it is inconvenient or that some are tired of discussing it. I note that the complaintant is not a regular contributor, none of whom have suggested “moving on”??

Do not assume that my nitpicking suggests a lack of respect for you or your work. Your blog is my main ‘think pad’ and sounding board. Like everyone else, I have my own theories and agenda.

Thanks DownSouth for the Kaplan and Gurven web link. A primary cause of disruption to reciprocal altruism would appear to be poor emotional nuturing of babies. See Sue Gerhardt’s books “Why Love Matters: How Affection Shapes a Baby’s Brain.” and the “The Selfish Society: How We All Forgot to Love One Another and Made Money Instead.” Her are two article links that involve these books:-

http://www.guardian.co.uk/books/2004/jul/17/highereducation.booksonhealth

http://women.timesonline.co.uk/tol/life_and_style/women/families/article7080372.ece

Schofield,

Thanks for dropping those links. Eye-opening work. I found an even better review of The Selfish Society here:

http://www.telegraph.co.uk/culture/books/bookreviews/7719614/The-Selfish-Society-by-Sue-Gerhardt-review.html

Amy Goodman’s interviews with Gabor Maté cover similar material and understanding of our brain development and proneness to addiction.

http://www.democracynow.org/2010/2/3/addiction

http://www.democracynow.org/2010/2/15/dr_gabor_mat_when_the_body

This work is important for adjusting to a future without bountiful consumer products.

Yves, you nailed it. I was so disappointed reading this dreck from Nocera this morning.

Very incisive and well informed analysis;; best wishes.

If not Wall Street, then the FIRE sector, and the failure of government to regulate, etc – all in an effort to make the “inside job” thesis more palatable. But is this really an account/excuse devoid of historical context intended to focus on a tree or two so that we miss the forest and its organic growth over time? This is not the first “financial crisis” since 1970, but merely the most recent – the latest and the greatest! And it probably won’t be the last.

Reminds me of Watergate and its aftermath. A few zealots in CREEP got carried away, some of whom were convicted and went to prison, a sitting President resigned, and then the American public rolled over and went back to sleep, believing that the “national nightmare” was over. Just six years later Ronald Reagan proclaimed that America was back…

We Americans so desperately want to believe that it was just “them” and not us. We’re victims – always victims. WE just did what we were told. Like an alcoholic or a drug addict who has yet to hit bottom we remain in DENIAL, refusing to admit that the collective consciousness that enabled the “perps” to securitize/loot the future with paper – the credit spigot – had nothing to do with it. If this “experiment” had turned out differently, had it succeeded, would we even be having this conversation? Would “we” even be close to having a “crisis of conscience”? [Thanks to DownSouth’s previous comment above]

Just convict a handful of the most egregious examples, make these sacrificial lambs do time, and absolve this collective conscience of culpability. Reform of the FIRE sector is all that is needed. But we don’t need to change a thing! It wasn’t “our” fault. Many a “willing penitent” amonst us endorses more austerity – reform – as the cure for what ails US.

And back to sleep we go in the knowledge that all is well and America is on the mend – ROUND II. Or is it ROUND III or IV? How long does this stage of DENIAL last? At what point do we stop “looting the future” and realize that we must first QUIT believing in this kind of reform and then as individuals alter how we think and behave before any meaningful cultural change – an alternative to looting – can occur?

DENIAL is presumably followed by ANGER and there’s certainly evidence that some Americans are very angry. But if this anger does not result in fundamental individual transformation – quitting past behavior and recovery – it plays right into the hands of the looters that stand to gain from more “reform”, lulling us back into the reassuring complacency of the collective consciousness that made this looting possible in the first place.

We must first QUIT AMERICA and transform ourselves before we can transform it.

Mickey; There is a lot to be said for the KISS Principle. The original Constitution (If a true copy still exists), might be a place to start??

Not if you are black and/or a woman.

The “bankers” were giving out money (disguises as home loans) so they could earn huge bonuses.

And OMG the stupid people said: Yes, thank you, we will take the money!

All the big corporation, including in the major media, are now addicted to the bailout culture (loans and cheap finance) – for without it, many of them would be where they belong – out of business. They will say or do nothing to rock the boat that appears to be a smooth ride for them – for now.

The same is true for nearly every man and womam currently employed. Even if the water is up to the ‘gunnels’, you are still better off than those in the water or under it??

In his NYT piece, Nocera wants desperately to give us Republican dissenters on FCIC who are worldly-wise, not to say principled, if ever so slightly myopic. Yet somehow he neglects to mention that the dissenters famously voted to ban from the FCIC report (which they weren’t going to endorse anyway) several rather critical terms: “Wall Street”, “shadow banking”, “interconnection” and “deregulation. Odd that he says nothing about that episode…especially given that Nocera complains the final report contains too many words, and the (ideological) Republican dissent too few.

All this crap revert to the mean ==>

See: “Consider the example of a very long series of real house prices for a specific location, Herengracht-Amsterdam. The series stretches from 1628 to the present. Over the very long run, house prices tend to revert to their mean, regardless of the duration or amplitude of the phases of their cycle.

The current housing cycle has been unusual when compared to average characteristics of similar cycles in the OECD economies from 1970 to the present. Its upturn lasted almost twice as the average (41 compared to 21 quarters) and its amplitude was almost four times larger than average (113% compared to 39%). Its downturn, however, has lasted only 14 quarters so far, while the average is 18, and its amplitude has been just -15% with the average at -22%.”

From: Patching Up Pin Prick Holes Inside Bubbles — and how to survive prices that revert to the mean, in almost all cases

Yeah, people getting the flu over and over again too.

I still blame the germs.

All this stuff you say, over and over and over, happened, greed, but I remember people “flipping” homes and plenty of taxi cab talk on buying real estate, cable shows devoted to the subject, etc.. All with borrowed money, so it depends on who you think is immoral the borrower or the lender. I guess its case by case but youve got to put some of this on real estate mania. I think? Right? For some the lender is always immoral, for others the borrower, it’s clear where you stand.

All you provide here is prejudice, and on a consistent basis, and then you accuse me of bias. Unlike you, I wrote an entire book on the crisis, and provide a detailed account, including a computation of the impact of CDO strategies of the subprime shorts on the cash bond market for subprime, as well as how many CDOs were on certain dealer balance sheets as a result of bonus gaming (the negative basis trade) and how significant those losses were. Unlike you, I did real forensic work (including getting extensive input from securitization experts and people on CDO desks, people who were at the table when deals were designed, negotiated, and sold) and have the goods.

All you have is anecdotes. You can’t even bother to deal with the facts presented in this post. that subprime in and of itself was not sufficient to produce a global financial crisis.

So some people flipped houses. As scraping_by points out, it was a cottage industry at best. Tell me exactly how significant an activity that was relative to the crisis, tell me the causation in terms of how mere house flipping produced a global financial crisis rather than losses at a few lenders and maybe then we can have an intelligent discussion. But you are the one who comes here with a consistent “blame the little guy” bias, and to top it off, you NEVER muster data.

And you even seem to have sample bias in your taxi cab drivers. I routinely ask taxi drivers when I’m traveling how the economy in their area is. Quite a few taxi drivers outside NYC would tell me how crazy the housing market was (this included places like Maine, which were not bubble epicenters) and how the bank had tried to get them to borrow more (as in buy a bigger house) than they thought they could afford. The typical conversation went, “You are only borrowing $140,000 to buy this house, but you can afford to borrow $185,000….are you sure you don’t want to buy a bigger house?” They turned them down. And I never ran into the sort of taxi driver you seemed to find routinely (or are yours mere figments of your imagination? I’m not denying they exist, but this simply illustrates why anecdotal information is crap).

So if you believe in anecdotal research, which you seem to, there is evidence of banks pushing borrowers to take on more debt. And some people are financially unsophisticated. If the bank, the supposed expert, says they can afford more, they”ll think the bank is right, they know more about this than they do. If your doctor suddenly told you it was OK to eat bacon and drink milkshakes on a routine basis, a lot of people would take that seriously too. But you don’t want to consider a narrative where anyone other than the little guy is at fault.

As Tanta (god rest her soul) used to say;

If your going to use anecdotes you need to use all of them

I was in the real estate business here in Dallas between 1979 and 1988. Some of the famous S&L crooks were parading around town in like they owned the world. There was a painter named Faulkner who got together with a few politicians and a S&L. The S&L was run by a previous head of the Federal Home Loan Bank and they sold participation in these future empty buildings. In about 2 years an entire city of Condos sprung up along IH35. We had a new governor and Attorney General and they were guests at an investor breakfast, complete with money to pay down their campaign debts. Thousands were sucked in. This was probably the best known scam here, but not the biggest. There were a lot of serial flips, where land had been sold several times and all the deals closed at once, kind of like MERS, except with the chain of title intact. This area has grown up since, but there are locations today that wouldn’t bring what they did in the 1980’s.

It was free access to money that allowed this to go on. These guys were booking profits out of loan fees then financing the next deal. Flips don’t happen too often to this degree without bankers in search of fees. One S&L owner had 2 private jets at Addison Airport. William Black labels Vernon Savings, run by Don Dixon as one of the 2 big ones. This was all done to generate fees and funded with government guaranteed money. It was also done with the ability to pass the trash to someone outside the area.

Lost on all of this is the massive amounts of money put into development deals. Housing brings strip centers, capital improvements by cities and a mass of other expenditures that go way beyond the subprime market. To center this in nothing more than the subprime game when it spans a myriad of Wall street and big bank business is to leave something out.

It is my understanding that these guys are all required to read Mania’s, Panics and Crashes by Kindleberger. This is all text book as Yves says and it was done for the fees. Note that all the firms went public. I doubt any of them would have been involved to this extent otherwise. As I posted above, I have been watching this in slow motion for 10 years. These games always blow up. Watch China, Canada and Australia in the next couple of years. This has nothing to do with Peak Oil. Oil was $100 a barrel inflation adjusted in the early 1980’s. That economy was due to Volker choking it for several straight years, not oil prices.

Okay, but thats not what I said, and I’m not sure thats what this guy is saying. All I’m saying is that there was surely a mania in housing and that more than a few borrowers took risk to buy and sell homes. You’re saying that never happened? Do you want a research report on that subject?

But, there is no way that sub=prime borrowers and “the little guy” caused the meltdown. Remember Ben Stein proclaiming all is well and tht sub-prime is no big deal? I would agree and disagree with that sentiment. Agree because you’re right, its not enough to melt the financial system. Disagree because it was the match that lit the house on fire.

But there would be no house to burn if not for the real cause of the meltdown. To me, and you’ll love this, the primary cause of the financial meltdown was repo and short term wholesale financing. That and allowing the animal spirits of finance to use bank balance sheets and borrowing lines. I have mentioned on this blog many times that banks and brokerages should not be under the same roof.

A moral judgement about wall street and greed is like saying look at that black pot, and saying “its black” like thats some revelation. There’s a place for this stuff but big banks and insued depositors are not that place.

Look, I think you’re blog is great, I think the stuff your doing on MERS and such is important. CDO’s as well. I think we agree on more than you might admit. But sometimes I violently disagree with you, so what. You don’t need to remind me that you wrote a (the) book. I have a pile of advanced degrees and 20+ years of experience in the credit markets – I’ve written, researched, read way more than I should have on these subjects so believe me, I get it.

Joe Nocera is at this very moment about to rock the historical analysis of the Dutch tulip bubble. He will expose documents detailing the vast securitization of the tulip debt market and the long-sought pristine CDOsquared crimson striped tulip, current market valuation $50 billion Euros which puts the Facebook frenzy in its rear-view mirror ( I think it was a dejected Dutch tulip default swap innovator who forged the first rear-view mirror. Go get em Joe !

The real problem with bubbles, I think, is people with too much money. Why invest in tulips? People who struggle daily to buy food or shelter won’t have money to buy tulips. It’s only when there’s more money than proper investment opportunities that bubbles appear.

A bubble looks to me like a ponzi scheme. The ones first in make a killing, the one last in loose a lot if not all of their money. Perhaps they are created on purpose by people who know how to manipulate and influence markets, and at some point they grow under their own strength of deluded investors appearing to get an initial high return on investment.

Yves, good stuff but it is time to move on. Your blog has become useless in terms of the future of the US economy than foreclure fraud and forensic analysis of a housing bubbble that has been beaten to death. Itt is better to now focus on the HB aftermath.

Ahem, your comment just proved the point. The crisis was not the result of the housing bubble, it was not a sufficient cause. The perpetuation of that meme serves the financial services industry.

Second, this is not a dead issue. In case you missed it (and you evidently have) a ton of financial regulation is being finalized. Dodd Frank, despite its considerable length, did not go into fine details; those are being negotiated NOW between the banks and regulators. Keeping noise up on why we had a crisis is thus relevant. And my politically oriented colleagues in DC confirm this view.

Third, in case you also missed it, the financial media is full of articles on the FCIC report. You are trying to tell me this is not a news story? Really?

Fourth, this blog has been in the vanguard of reporting on foreclosure fraud and securitization abuses. This is a very much a live issue.

My view of #2: I really fail to see the point of patching a rotten boat. I also question the validity of having new rules being determined by ‘negotiations between the banks and the regulators’, both of whom failed in their responsibilities the first time around? Wouldn’t it be more appropriate to search for qualified ‘independant’ draftees?

Having foxes negotiate the terms of henhouse security seems counter intuative at best.

I agree this is not likely to turn out well, but the more there is in the public domain, the fewer the “whocouldanode” excuses when we go into crisis mode again. The officialdom is now getting away with the exposure of their head in the sand approach pre crisis because they’ve patched up the leaky garbage barge enough to get it back in the water and not have it sink immediately. But if it sinks in the next 2-3 years, which I regard as likely, it will be much harder for those at the top of the food chain to remain in there. That’s why not letting this go away is important, to create accountability.

So a burglar comes into your house and steals your savings from under the mattress. Police are pretty sure who it was, but not certain enough to make an arrest and recover your savings.

But a lot of time has passed, and more time will be required, so it is “better” just to forget about that lost savings and concentrate on building new savings.

Do not know many who would agree with that thought process.

Yves, here is a short account by Steve Keen, who I regard as one of the upfront people who knows what is happening. He appears to agree with you on most points. I haven’t read your book. I am going to.

http://www.debtdeflation.com/blogs/2011/01/30/the-fcic-report-sound-and-fury-signifying-nothing/

The U.S. banking system is bankrupt?